Chile’s economic resilience

By Soledad Soza

Source: https://www.academia.edu/22153397/TOP_5_RISKS_AND_OPPORTUNITIES_CHILE_2016

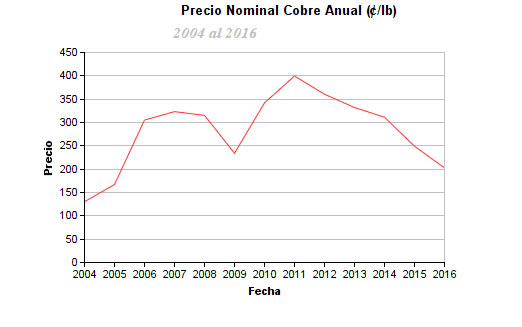

Chile has an open economy, and the country is connected to global markets through several FTAs signed with major commercial partners. Chile’s most significant revenues come from copper mining exports. China became its biggest buyer during the commodities boom, which accounted for a yearly 5% growth in the super commodity cycle (2004-2011). China’s accelerated growth was a driver in sales around the globe, particularly for Chilean copper exports; however, a fiscal rule in force since the transition to democracy (1990) meant the implementation of anti-cyclic policies, i.e., Chile wisely invested its revenues from copper sales on infrastructure and public goods and did not exceed imports over export. The super commodity cycle allowed for stability, governance, and fiscal saving. During the 25-30 -year-political cycle, CODELCO, the national-owned copper company, accounted for 15% of the country’s GDP. In a diversified export matrix, revenues come from other raw material exports, including salmon, wood, fruits, and wine.

The 2008 subprime crisis and the 2009 European slowdown did not hit Chile seriously. Sound macroeconomic policies, fiscal austerity, and wise investment have provided the necessary shield against economic shocks. However, the current volatility in global markets due to China’s decision to change its matrix from manufacturing to service-oriented has produced continued uncertainty and instability in global stock markets. The fall in commodities, the strengthening of the dollar, and the FED’s announcement to raise interest provide a pessimistic scenario for Latin America. Bloomberg estimates that Chile has a 5% chance of being hit by a recession phase as China continues its slowdown. Thanks to prudent macroeconomic policies, Standard & Poor’s has again confirmed AA+ on financial resilience in Chile.

RISK:

Due to China’s slowdown, an appreciated dollar, and the fall in oil prices, volatility and instability in the global markets are risks to emerging countries in 2016. The Latin American and Caribbean countries see their raw material prices go down. China’s slowdown affects the market and the region's exports, particularly mining products from Chile. The FED’s announcement to gradually raise the interest rate did not hit the market severely. Still, it is beginning to affect imports and inflation rates in emerging economies with an appreciated dollar. Countries that did not invest wisely on China’s demand for raw materials are more likely to be hit, those countries like Chile that invested wisely and handled their balance sheet in order will cope better. The copper boom in Chile has meant exploration projects to replace old mines; these will go forward despite China’s slowdown. Chile is not only the biggest copper producer globally but also concentrates 35% of additional unexplored resources worldwide; consequently, a production limit will go slower than expected. Therefore, copper prices will still be low in 2016 (around US$ 2), and this trend will probably continue in 2017 and 2018 due to overproduction worldwide and costly exploration projects. Prices may go up (around US$3) by 2018 when companies manage to limit production. CODELCO’s lower sales will be a significant concern for the Government in 2016. Copper price at US$ 2 or below means practically zero revenues for the state. Against a pessimistic scenario of a copper price below US 2, the fiscal rule in force means implementing a tightened budget that limits Chile's social expenditure.

OPPORTUNITY:

Responsible fiscal policies provide Chile with resilience to cope with a pessimistic scenario. This trend of moderation and anti-cyclic measures allows Chilean pragmatism to prioritize macroeconomic targets and keep the inflation rate at 3%. Chile is issuing bonds at a 4% interest rate with a favorable spread, a sign of confidence in Chile’s stable financial sector. Opportunity for Chile to boost its diversified matrix, i.e., salmon, fruits, wood, etc., to its commercial partners in 2016. In 2015, both America and China dropped their barriers on imports from Chile as part of their phase-out agreement to reach 0% tariffs so the local food industry could find additional incentives for bigger sales. Furthermore, the signature of the TPP by 2016 in Auckland, NZ, by all 12 members (including the USA) appears as a significant opportunity to sell products from a diversified matrix to the rest of the world once TPP is ratified in each member's Congress within two years.